Best Accounting Software in Pakistan

Introduction

From startups to huge businesses or enterprises, as a Corporate and Tax Lawyer with about 20 years of experience in Pakistan, I have successfully advised a vast number of businesses on tax compliance, corporate structure, regulatory as well as audit.

However, during my fieldwork, I observed that poor or low accounting is the primary source or cause of most legal, compliance clashes, and tax issues. Thus, businesses need to understand that the best accounting software in Pakistan is not just a convenience; it is a legal protection that ensures transparency, accuracy, and readiness against scrutiny by authorities like SECP, FBR, and other provincial tax departments.

So, if you are a startup or a well-established business managing challenging transactions, it is crucial to choose the best accounting software in Pakistan as it ensures that your business is secure financially, legally, and operationally.

Keep reading this article, as it will guide you on why you need to invest in a reliable accounting software that ensures long-term stability as well as growth.

Importance of Accounting Software from Legal and Tax Perspectives

Based on my professional journey and expertise, the best accounting software in Pakistan is the one that provides real-time financial reporting, proper invoice management, safe record keeping, and automatic tax calculations, allowing businesses to stay secure and compliant while making smart financial decisions.

Additionally, the enterprises that invest in consistent accounting software are the ones that ensure their safety from financial crisis. Beyond compliance, reliable software is the system that improves internal controls, boosts investors’ or clients’ trust, and decreases the need for manual accounting.

However, as per Pakistani law, it is mandatory for businesses to strongly and accurately maintain proper books of accounts under:

- The Income Tax Ordinance, 2001

- The Sales Tax Act, 1990

- SECP regulations (for firms)

- Provincial Tax Authorities (PRA, SRB, KPBRA, BRA)

However, if firms fail to maintain an accurate record, they are going to face the following challenges:

- Tax penalties along with audits

- Disallowance of expenses

- Legal notices and lawsuits

- Problems will occur to businesses during fundraising, diligence, or business sale

The Role of Accounting Software in Pakistan

Having practical experience, I have thoroughly witnessed how financial management faced regulatory penalties, tax disagreements, and lengthy lawsuits for businesses. In most scenarios, it was found that the primary cause of the issues was outdated or non-compliance or also inefficient accounting practices.

In addition, the role of the accounting software in Pakistan lies in its potential to smartly act as the backbone of the financial governance. Its major purpose is to ensure the firms are secure and are maintaining accurate records, meet statutory obligations, and remain fully prepared for audits from SECP, along with FBR.

Furthermore, in today’s growing regulatory landscape, the crucial role of the accounting software is beyond compliance into smart decision making. The enterprises that choose the best accounting software will be able to gain great financial visibility, potential internal controls, and credibility with investors.

Common Accounting Mistakes to Avoid

After experiencing or viewing hundreds of enterprises make many accounting mistakes, due to which they face many legal problems or challenges. From a legal perspective, I suggest avoiding the following common accounting mistakes by adopting an innovative and accurate accounting system in Pakistan.

However, below are the common accounting mistakes that businesses are required to avoid:

- Entities are required not to rely on manual bookkeeping or unstructured records, which leads to inaccurate financial statements along with missing documentation.

- Try not to mix personal and professional finances, as it is a practice that weakens corporate reliability and leads to several legal risks.

· Avoid recording transitions without adding invoices, contracts, or even bank evidence, assuming that it will be arranged later. Timely and accurate data entry ensures that enterprises make sound financial decisions.

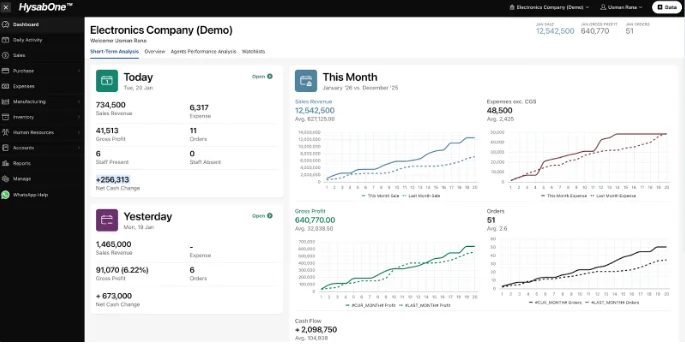

Hysabone: The Perfect Alignment with Pakistan’s Tax & Legal System

Being one of the best accounting software in Pakistan, Hysabone is perfectly aligned with the tax and legal system in Pakistan. Moreover, after the successful 20 years of my experience in corporate and tax law, I have become clear on one thing, which is that great accounting protects against bad legal outcomes.

Thus, for firms operating in the complicated regulatory environment, selecting an ideal and correct accounting system like Hysabone is a strategic move. The software stands out due to its reliability and compliance with complications. Furthermore, the accounting software is ideal for:

1: Effectively Accounting Structure Compliant with FBR

The best feature of the Hysabone is that it assists enterprises with maintaining clear, effective, and auditable records, decreasing the risk of audit, and safeguarding firms from fraud or facing scurrility. Check out how Hysabone helps businesses have better audit records that are smartly aligned with:

- Income tax filings

- Sales tax reports

- Withholding of tax statements

- Audit trails needed by FBR

2: Correct Financial Reporting for Legal and Tax Verdicts

While making a financial report for legal and tax purposes, it is better to consider Hysabone, Pakistan’s best accounting software, as it provides an accurate and trustworthy financial report. However, if you are about to make such financial decisions, this software is effective for you in the following ways:

- Applying for financing

- Assist you in preparing an audit

- Allow you seamlessly enter into a partnership

- Enabling you smartly respond to a legal notice

3: Perfect for SMEs, Growing Businesses, and Startups

In Pakistan, there are many SMEs, or startups, that are facing several issues, such as complicated software and poor local tax application, along with high execution costs, which won’t let them from growing effectively.

However, Hysabone is still well-suited for startups, SMEs, business owners, accountants, and tax consultants in Pakistan, as it provides accurate and reliable financial reports.

How Hysabone is a Reliable Accounting Software in Pakistan

Based on my years of experience, Hysabone is one of the great, relevant, and legally aligned innovative accounting software in Pakistan. It is a better option for businesses when reviewing accounting records during corporate audits and tax assessments.

- The software allows accountants to smartly maintain their financial records for numerous clients

- It assists in decreasing errors in tax filings

- Allow firms to easily prepare audit-ready data

- Hysabone is created to meet the real-time requirements of the Pakistani enterprises, not generic global expectations.

- The software ensures that record keeping for sales tax and income tax, along with withholding obligations, is easy, making Hysabone a perfect choice for responding to FBR audits as well as notices

- This accounting software is also useful for allowing enterprises to properly check the transaction history and documentation in order to protect themselves during audits and legal scrutiny.

- Hysabone is also beneficial SME accounting software that helps small and growing businesses, as it lets them grow efficiently without overwhelming them with unnecessary complication.

Effective Advice to Business Owner and Professionals

It is quite evident that businesses face challenges not just because of their non-compliance but also due to their poor accounting systems at important moments like disputes, audits, or investor reviews.

Considering all the factors and the importance of accounting software in Pakistan, I recommend enterprises or businesses smartly choose a system like Hysabone that seamlessly understands taxation, business realities, and laws in Pakistan. Additionally, the software is primarily designed to support firms run legally and strategically.

Final Thought

Considering my 20 years of experience as a Corporate and Tax Lawyer, I understand that most of the accounting and compliance problems which are faced by enterprises in Pakistan are due to the complex tax treatment, and it is also due to the fact of avoiding errors or a weak financial system.

It is high time for business to avoid such mistakes and step ahead with applying the best accounting software in Pakistan which is supported by properly regular oversight as well as professional review, allowing business to smartly manage or maintain records and ensure better audits and legal inquiries.

In short, in a world where people consider documentation is everything, the innovative software Hysabone is not simply software; it is the perfect protection for businesses against all financial challenges.

About the Author: This article draws on insights from over 20 years of corporate and tax law practice in Pakistan, representing businesses from startups to listed companies across sectors, including manufacturing, services, technology, and retail. The author has advised on hundreds of FBR audits, tax disputes, and corporate transactions where accounting documentation proved critical.

Note: The article contains general details or guidance regarding accounting software in Pakistan based on years of professional experience. However, make sure to still get in touch with competent corporate or tax lawyers before making any financial decisions.

Recent Posts

Have Any Question?

- (+62)81 157 5891

- support@domain.com